Companies That Attempt to Increase Their Invest in Stateoftheart Staffing

Entrepreneurs and their impact on jobs and economic growth

Productive entrepreneurs can invigorate the economy by creating jobs and new technologies, and increasing productivity.

DIW Berlin, Academy of Potsdam, and IZA, Federal republic of germany

Elevator pitch

Entrepreneurs are a rare species. Fifty-fifty in innovation-driven economies, but 1–2% of the piece of work force starts a business in whatever given year. Nevertheless entrepreneurs, peculiarly innovative entrepreneurs, are vital to the competitiveness of the economy. The gains of entrepreneurship are just realized, nonetheless, if the business organization surround is receptive to innovation. In addition, policymakers need to prepare for the potential task losses that can occur in the medium term through "creative devastation" as entrepreneurs strive for increased productivity.

Key findings

Pros

Entrepreneurs boost economical growth past introducing innovative technologies, products, and services.

Increased competition from entrepreneurs challenges existing firms to become more than competitive.

Entrepreneurs provide new chore opportunities in the short and long term.

Entrepreneurial activity raises the productivity of firms and economies.

Entrepreneurs accelerate structural change past replacing established, sclerotic firms.

Cons

Only a few people have the bulldoze to get entrepreneurs.

Entrepreneurs face up a substantial hazard of failure, and the costs are sometimes borne by taxpayers.

In the medium term, entrepreneurial activities may lead to layoffs if existing firms shut.

A high level of self-employment is not necessarily a good indicator of entrepreneurial action.

Entrepreneurship cannot flourish in an over-regulated economy.

Author's main message

Entrepreneurship is important to economic development. The benefits to society volition exist greater in economies where entrepreneurs can operate flexibly, develop their ideas, and reap the rewards. Entrepreneurs answer to high regulatory barriers by moving to more innovation-friendly countries or past turning from productive activities to non-wealth-creating activities. To attract productive entrepreneurs, governments need to cut ruby-red tape, streamline regulations, and prepare for the negative effects of layoffs in incumbent firms that fail because of the new contest.

Motivation

When an economic system is doing well, at that place is less incentive to encourage new, entrepreneurial firms. When people and firms are making money, why take a gamble on something new and untested? Entrepreneurs often challenge incumbent firms, and while this might seem undesirable, unchallenged, established firms tend to go conceited, content to take their profits without investing in enquiry and development to improve their business. These stagnating firms are the start to suffer when imports arrive—withering rapidly, unable to respond to the competition. Thus, challenging incumbents to do better during good economical times is a benefit of entrepreneurship.

Entrepreneurs are equally, if non more, important when the economic system is doing desperately. When unemployment is high and the economy is contracting or stagnating, dynamic entrepreneurship could help turn the economy around. By developing novel products or increasing contest, new firms can boost need, which could in plough create new job opportunities and reduce unemployment.

If entrepreneurs are consistently encouraged, in bad economic times as well as expert, then all businesses are kept on their toes, motivated to work continuously to improve and arrange (see Different types of entrepreneurs). Entrepreneurs are the fresh blood that keeps economies salubrious and flourishing fifty-fifty as some individual firms fail.

Capitalist economies are not alone in encouraging entrepreneurs. Managed economies, such every bit China's, are showtime to encourage and facilitate entrepreneurship. They have discovered that entrepreneurial activities, once viewed every bit a threat to the established system, are crucial for maintaining economic competitiveness and for achieving long-term success.

Discussion of pros and cons

Entrepreneurs innovate innovations and induce economical growth

Entrepreneurs often create new technologies, develop new products or process innovations, and open up new markets [1]. There are many examples of radical innovations introduced past entrepreneurs such as Pierre Omidyar (eBay), Larry Page and Sergey Brin (Google), Larry Ellison (Oracle), Dietmar Hopp and Hasso Plattner (SAP), Bill Gates (Microsoft), Steve Jobs (Apple), and Stelios Haji-Ioannou (easyJet), to name merely a few.

Radical innovations oftentimes pb to economic growth [2]. Entrepreneurs who bring innovations to the market offering a key value-generating contribution to economical progress. Compared with incumbent firms, new firms invest more than in searching for new opportunities. Existing firms might be less probable to introduce considering of organizational inertia, which numbs their responsiveness to marketplace changes, or because new appurtenances would compete with their established range of products. Incumbent firms often miss out, sometimes intentionally, on opportunities to adopt new ideas because of the fear of cannibalizing their own markets. For inventors and innovators (who sometimes come from established firms) setting upwardly their own concern often appears to be the but way to commercialize their ideas.

Entrepreneurs increment competition

By establishing new businesses, entrepreneurs intensify competition for existing businesses. Consumers benefit from the resulting lower prices and greater production variety. Researchers take developed a measure of market mobility, which identifies the effects of new business germination on existing firms [three]. A modify in the ranking of established firms by number of employees indicates a transfer of market place share and college market place mobility. This effect is particularly strong when considering entrepreneurial activeness five years prior to the start-upwards, which points to a substantial time lag in the effect of start-ups on market mobility. Furthermore, new business organization formation has an indirect contest-enhancing effect by pushing established firms to improve their performance.

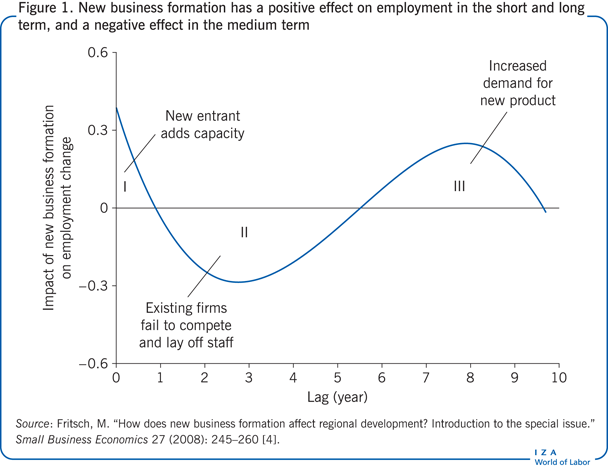

Entrepreneurs accept positive employment effects in the short and long term, and negative effects in the medium term

Entrepreneurs stimulate employment growth by generating new jobs when they enter the market place. Research has shown (after disentangling all the potential effects) that beyond this firsthand effect there is a more complicated, S-shaped event over time (Figure ane) [4]. There is a direct employment consequence from new businesses that arises from the new jobs beingness created. Following this initial phase, in that location is usually a stagnation stage or even a downturn every bit new businesses proceeds market share from existing firms that are unable to compete and as some new entrants neglect. Later on this interim stage of potential failure and deportation of existing firms, the increased competitiveness of suppliers leads to positive gains in employment one time once more. About ten years afterward commencement-up, the affect of new business organisation germination on employment has finally faded away. This blazon of wave pattern has been found for the U.s. and for a number of European countries, also as for a sample of 23 Organisation for Economic Co-operation and Development (OECD) countries [v].

New businesses boost productivity

Competition betwixt new and existing firms ideally leads to survival of the fittest. Even though overall employment may decline, new firms can foster productivity [6]. The productivity-enhancing effect of business concern formation occurs in the medium term, when the employment upshot is dominated by the displacement of existing firms (area Ii of the "wave" shown in Effigy 1). This happens for two reasons. Offset, new firms increase competition in the market and thus diminish the marketplace power of incumbent firms, forcing them to become more efficient or go out of business. Second, only firms with a competitive advantage or firms that are more efficient than incumbents will enter the market. The subsequent pick process forces less efficient firms (both entrants and incumbents) to drop out of the marketplace.

Entrances, exits, and "turbulence" (the sum of entries and exits of firms in a given yr) have been shown to have a positive overall effect on productivity, as measured by diverse indicators of productivity in several European countries. These effects were found for a sample of 23 OECD countries [6], and in unmarried country studies for Federal republic of germany, the Netherlands, and Sweden.

In the initial years following entry, the productivity effect can sometimes be negative, probably a event of adjustments to routines and strategies in response to the new entrants. The overall positive relationship is particularly strong for entrepreneurs with high-growth ambitions and a high degree of innovation; the issue on productivity is weaker for entrepreneurs with low-growth ambitions. This blueprint indicates that entrepreneurs generally increase the productive utilize of deficient resources in an economy, with the strongest impact coming from innovative entrepreneurs.

Entrepreneurship encourages structural change

Existing firms oft struggle to adjust to new market conditions and permanent changes, getting locked into their one-time positions. They fail to make the necessary internal adjustments and lack the ability for "creative devastation," famously described by Schumpeter in 1934 [7]. The entry of new businesses and the exit of worn-out firms can assist to free firms from a locked-in position. Moreover, entrepreneurs may create entirely new markets and industries that become the engines of time to come growth processes.

Only a few people have the drive to become entrepreneurs

Entrepreneurs share certain traits, such as creativity and a high tolerance for the uncertainty that comes with developing new products. Four personality characteristics are peculiarly important for becoming an entrepreneur: willingness to bear risks, openness to feel, belief in their ability to control their ain future (internal locus of command), and extraversion [8]. Entrepreneurs are significantly more than likely to have these traits for the following reasons:

-

The success of each investment, particularly in innovative activities, is unpredictable. Every entrepreneurial decision is risky, and success is never assured. In contrast to ordinary managers, entrepreneurs often put their ain funds on the line and risk losing money if the investment fails. They take to be willing to deport risks.

-

People who are open up to experience—who seek new experiences and are eager to explore novel ideas—are artistic, innovative, and curious. These attributes are vital for starting a new venture.

-

Locus of control measures generalized expectations about internal and external control. People with an external locus of control believe that their future is adamant randomly or by the external environs, non past their own deportment. People with an internal locus of control believe that they shape their future outcomes through their own deportment. Entrepreneurs need to have an internal locus of control to propel them.

-

People who are assertive, ambitious, energetic, and seek leadership roles (in the and then-called "Large Five" approach this trait is called extraversion), tend to exist sociable as well, enabling them to develop social networks more easily and to forge stronger partnerships with clients and suppliers. All of these traits—existence believing, seeking leadership, and developing networks—are important if an private aims to go an entrepreneur.

While these personality traits bear on a person's decision to become an entrepreneur, different traits or parameter values of these traits touch on the success of entrepreneurship and the decision to abandon or persevere in the new effort. Empirical enquiry reveals that the almost important personality characteristics influencing entrepreneurial success are lower levels of conjuration, higher levels of need for accomplishment, college levels of (internal) locus of control, and medium levels of risk acceptance:

-

Agreeableness refers to having a forgiving and trusting nature and being donating and flexible. Lower scores on agreeableness might aid entrepreneurs survive past enabling them to bargain more than for their own interest with their partners.

-

For entrepreneurs, a demand for achievement is expressed in the search for new and improve solutions and the ability to deliver these solutions through their own performance.

-

The same holds for having higher levels of internal locus of control. Assertive that one shapes one'south ain future through one's ain deportment is a very useful trait for entrepreneurial success.

-

Entrepreneurs with a medium range of risk tolerance accept the lowest exit probabilities. The relationship between take a chance tolerance and the probability of entrepreneurial success is not linear but an inverse U-shape [eight]. Too low a risk tolerance leads to low-risk projects with low expected returns, which makes entrepreneurship an unattractive option to dependent employment, and excessive take a chance tolerance leads to projects that are very high adventure with high failure rates.

A substantial take a chance of failure accompanies entrepreneurship

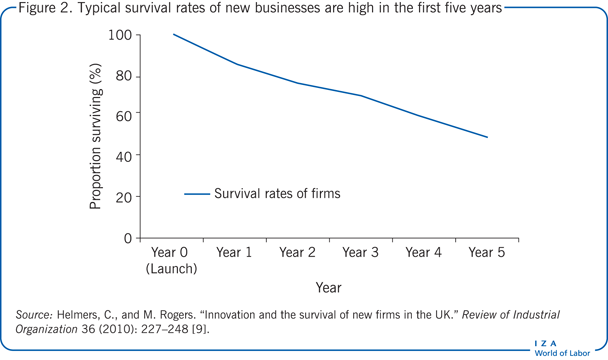

Failure rates are loftier within the first five years of starting a business, typically around twoscore–l%, with the highest failure rate in the showtime year (run into Effigy 2). Recent studies in Frg and in the United kingdom take shown college survival rates for new ventures in innovative industries [9].

In that location are several reasons why new businesses fail and close (run into Failure versus closure). Non anybody who tries to kickoff a business has the right graphic symbol traits to go a successful entrepreneur. Other impediments to success are restricted admission to capital, lack of customers, and discouraging regulatory hurdles, including unfriendly entry regulations and hard and time-consuming requirements for registering belongings and obtaining or extending licenses or permits.

The level of cocky-employment is not necessarily an indicator of entrepreneurial activeness

Self-employment is not synonymous with entrepreneurship. The level of entrepreneurial activeness offers information about the dynamics of an economy, while the level of self-employment is non necessarily correlated with economic development. In fact, virtually economies with high levels of self-employment are less developed. Less developed economies have fewer large firms (which deliver economies of scale and scope) and a greater number of small-scale firms and self-employed individuals (delivering fewer economies of scale and telescopic). Thus, a loftier level of self-employment does not necessarily stand for with a high level of entrepreneurial activity.

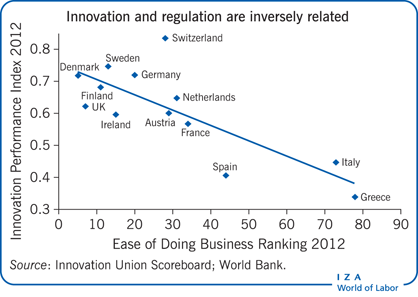

High regulatory burdens and unsecured intellectual holding rights are detrimental to innovative entrepreneurship

Regulatory obstacles to setting upwards a business concern, such equally the demand to purchase permits or licenses and other entry barriers, may discourage entrepreneurship. Overregulation of commerce prevents entrepreneurship from flourishing considering information technology increases the costs of starting a business and decreases flexibility and the ability to react rapidly to opportunities as they arise, thus reducing experimentation. Similarly, frequently changing, complex, unclear, or opaque regulations go far difficult to understand the legal environment for entrepreneurial activity.

Sometimes, overregulation tin even make entrepreneurship impossible by restricting or prohibiting entry into certain sectors of the economy through strict command of licenses. Permits and licenses can act as noncompetition agreements. Overregulated markets can turn potentially productive entrepreneurs toward unproductive non-wealth-creating activity. And considering there are many potential markets for high-tech innovations all over the world, innovative businesses deterred past overregulation in i market can get elsewhere.

A high level of corruption can be a side effect of overregulation, with directly negative impacts on innovative activities [10]. Success in entrepreneurship and innovation—which are about new products or services—is uncertain. Thus if intellectual belongings rights are not adequately enforced, this adds to the uncertainty, which tin build up to prohibitively high levels that discourage whatsoever potential innovators. Corruption may make entrepreneurs unwilling to trust the institutions that are necessary to protect intellectual property rights.

Limitations and gaps

Not plenty is known most the differences in innovation between entrepreneurs and large (often multinational) firms. While entrepreneurs are hailed every bit the source of radical innovations, it may well be that large firms, which tin make huge investments in research and evolution, are the real innovators. Both parties undoubtedly contribute to innovation, only whether they complement each other is still unknown.

Further empirical analysis is too needed of the relationship between entrepreneurial firms and economic growth rates. But while some truly innovative entrepreneurs create fast-growing businesses (so-called "gazelles") that take an of import bear on on economic growth, whether replicative entrepreneurs (see Different types of entrepreneurs) have a measurable issue on economical growth seems less likely. Only further study can respond this question.

At that place is too inadequate agreement of the kind of economic surround that influences innovative entrepreneurs not but to beginning their businesses, but also to expand them. This is an important effect since the quality of commencement-ups— their persistence, growth charge per unit, and innovation— influences their consequence on the economic system.

And we do non know enough nearly failure rates. About half of all businesses close in their outset five years. Still recent inquiry finds that survival rates could be higher. Information technology is non yet clear whether innovative entrepreneurs survive more often than noninnovative entrepreneurs. Research preceding that reported here found the opposite to exist the instance. It is as well not clear whether the human relationship between failure/closure and years of survival is linear. Some empirical analyses discover a linear relationship, while others find a college failure/closure rate in the first year.

Summary and policy advice

Entrepreneurship is considered crucial to a dynamic economy. Entrepreneurs create employment opportunities non just for themselves but for others also. Entrepreneurial activities may influence a land'southward economical performance by bringing new products, methods, and product processes to the market and by boosting productivity and competition more broadly.

Realizing these advantages requires institutions that contribute to an environment that is friendly to entrepreneurs. In particular, it is important to protect intellectual and other holding rights, streamline and enforce commercial laws, amend the business climate, reduce regulatory burdens, and create a culture of second chances for entrepreneurs who fail. More than specifically, the following policy measures should be considered:

-

Government policies and legislation on property rights are important in shaping a land's innovativeness. Protecting cloth belongings rights ensures that whatever wealth cosmos stays with the entrepreneur, while protecting intellectual holding rights fosters entrepreneurship and innovation.

-

Bureaucratic obstacles constrain innovation-driven activities in many economies. Entrepreneurial opportunities will be greater in deregulated economies with freely operating markets and efficient licensing, because entrepreneurs can operate flexibly and their entrepreneurial activities can respond to changes in the marketplace. It is besides of import that laws and regulations be enforced fairly and evenly.

-

Authoritative burdens for start-ups need to be low, including the fourth dimension needed to register a business organisation, the number of bureaucratic steps, and the number of regulations, fees, and reporting requirements. Equally a benchmark, leading business-friendly countries enable companies to register for business within one mean solar day, without the demand for regular renewal. This can exist achieved by setting upward a state-of-the-art online due east-assistants for all standard businesses.

-

Conflicting legislation creates uncertainty, and incertitude discourages business activity. Codification ways bringing all amendments to a given law, adopted at dissimilar times, into a single legal code. Swift and comprehensive codified of the legislation eliminates contradictions. It should too include reducing and unifying administrative procedures relating to a particular activity.

-

In many countries, a unmarried failed business endeavor brands a person for life every bit a loser. The opposite experience in the US, where entrepreneurs are more readily given a second run a risk, fifty-fifty following a bankruptcy, makes clear that destigmatizing failure is crucial to the evolution of a rich entrepreneurial civilization. Creating such a culture also reduces the fright of failure, which is yet the most important impediment to entrepreneurship.

-

The negative effects of layoffs in firms that are unable to compete can exist eased by improving search options for new jobs and by supporting vocational training for workers who lost their jobs.

-

Showtime-upward subsidies should be considered to foster entrepreneurial activities. These can reduce the risk of early business failure.

If regulatory burdens are reduced and corruption is eliminated, countries will encourage and retain their own entrepreneurs and even attract innovators from other countries. Thus, policy can influence the volume of entrepreneurial activity most effectively by adjusting the regulatory environs in favor of entrepreneurship.

Acknowledgments

The writer thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA Earth of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Alexander Kritikos

Source: https://wol.iza.org/articles/entrepreneurs-and-their-impact-on-jobs-and-economic-growth/long